Making smart decisions with money involves a combination of careful planning, discipline, and informed choices. Here are some tips:

Create a Budget: Know where your money is coming from and where it’s going. Create a budget that outlines your income, expenses, and savings goals.

Emergency Fund: Build an emergency fund to cover unexpected expenses. Having three to six months’ worth of living expenses set aside can provide financial security.

Set Financial Goals: Define short-term and long-term financial goals. Whether it’s saving for a vacation, buying a home, or planning for retirement, having clear goals helps guide your financial decisions.

Avoid Debt or Manage it Wisely: Try to minimize high-interest debt, and if you have it, come up with a plan to pay it off. Use credit responsibly and be mindful of interest rates.

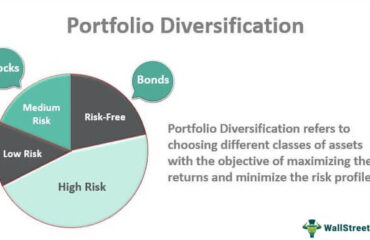

Invest Wisely: Understand your risk tolerance and invest in a diversified portfolio. Consider long-term investment strategies, such as retirement planning.

Educate Yourself: Stay informed about financial matters. Knowledge is key to making informed decisions. Read books, attend seminars, or seek advice from financial professionals.

Live Below Your Means: Avoid lifestyle inflation. Just because you earn more doesn’t mean you have to spend more. Save and invest the difference.

Insurance: Protect yourself and your assets with appropriate insurance coverage. This includes health insurance, life insurance, and coverage for your home and car.

Review and Adjust: Regularly review your financial situation and adjust your plan as needed. Life circumstances and goals change, so your financial plan should be flexible.

Seek Professional Advice: If needed, consult with financial advisors or experts. They can provide personalized advice based on your specific situation and goals.

Remember, making smart decisions with money is a continuous process. It’s about building good financial habits and adapting to changes in your life and the economy.