The world is hit by a Corona virus pandemic. Lives are threatened. The lockdown world over also threatens livelihoods and businesses.

Surveys suggest if the lockdown continues for more than three months, around one thirds of businesses would be shut. If the lockdown continues for six months, 60 to 70 per cent businesses will be closed.

There could be many reasons for the closure of businesses – shrinking demand and unavailability of the labour. But, the foremost is lack of sustained cash flow. There are other studies that show that most businesses fail because of the cash flow and lack of financial planning.

Take for example, a multi-national telecom company Vodafone. It first merged with Idea to improve its market reach but again penalties and other legal issues involving huge cash have left the company unsustainable in comparison to a cash-rich Reliance Jio.

One may ask if financial planning could have saved a business in the times of a crisis. To some extent, it is possible to sustain even during the troubled times. A roadmap laid by an expert can help a businessman wade through the troubled waters.

Let us take an example of a roaring small business. It is a fairy tale. Good operations. Good orders and a solid cash flow. When the people saw the promoter’s grand house and an elegant car, the people thought he is a story of an instant millionaire. Friends and even family members who never counted him, now make sure they remain connected and shower praise. The businessman returns the compliments with costly gifts.

It seemed as if the dream run will march into eternity.

But, times change and when they change, they destroy everything.

Businesses also see drastic changes. There are cycles of ups and downs.

When there are known and unknown cycles of ups and downs, there are also ways to handle them.

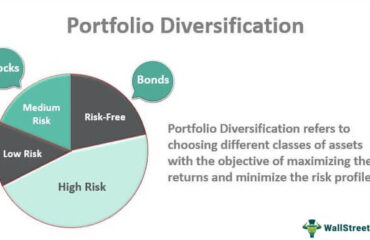

The surpluses have to be seen from different perspectives – investing for oneself, the promoter; investing for reinvestment in the business for its growth and keeping a provision for a possible downturn and keeping a provision for things like the pandemic or the 2008 sub-prime crisis

through insurance tools.

Down turn comes and wipes off all the wealth one creates – car, house and investment in the property. No money is left to re-invest in the business to change it according to the times and even sustain it during a slowdown. If money was managed well, one could have even bought a competitive business to expand one’s base, instead of his own running business coming to a close.

Every downturn creates new heroes. They were those prepared for bad times. Do you want to become a hero in tough times? Or, you want to be counted amongst those who fail and blames circumstances and others for their failure.

The only difference between success and failure in bad times is that the successful ones have access to knowledge to deal with a tough time and the failed ones do not know.

Like!! I blog frequently and I really thank you for your content. The article has truly peaked my interest.

These are actually great ideas in concerning blogging.

I learn something new and challenging on blogs I stumbleupon everyday.

I am regular visitor, how are you everybody? This article posted at this web site is in fact pleasant.

Your site is very helpful. Many thanks for sharing!